Discover How To Buy Properties In High Potential Areas Before Prices Skyrocket And Still Collect Cashflow From Rental.

We use the "ROCK SOLID METHODOLOGY"

Our methodology focuses on:

At least $100,000 to $200,000

upside potential within 3-5 years

At least $100,00 to $200,00

upside potential within 3-5 years

Strong rental and cash flowgeneration potential even in a down

market to protect your portfolio

Strong rental and cash flowgeneration potential even in a down

market to protect your portfolio

Efficient Tax and Cashflow Planning:

No ABSD, minimal tax, low

maintenance or hidden expenses

Efficient Tax and Cashflow Planning:

Minimal tax, low

maintenance or hidden expenses

Strong tenant management

system to avoid unnecessary

hassle

Strong tenant management

system to avoid unnecessary

hassle

You’ll be learning from 1 of Singapore’s Top Property Investors – Dr. Patrick Liew

Dr. Patrick Liew, Ed.D, MBA, MSc, BSc, is the Chairman of GEX Global Group, a company that has won multiple awards, including the prestigious E50 Award.

He is one of the most successful entrepreneurs and investors in the region, and has helped list multiple companies in different countries.

Previously, he was the Executive Chairman of HSR Global Ltd, which he listed on SGX. He also founded Success Resources, arguably the largest seminar organiser in the world, and helped list it on ASX.

From his many years of experience in investment and entrepreneurship, he has amassed many lessons and strategies, which he now actively imparts to the members of the GEX community so that they may build on his experience.

Dr. Patrick also provides leadership and advisory services to many professional and charity organisations. He actively supports humanitarian, philanthropic, and charity causes.

He has won numerous awards including the Global Leader Award, Asia Pacific Entrepreneurship Award, and the Entrepreneur of the Year Award for Social Contributions.

Are there still investment opportunities despite these market conditions:

- Interest rates are going up

- Property prices are at an all-time high

- Large corporates are laying off staff

-

Businesses are still in recovery mode

Over the last 30 years, we have been riding the ups and downs of the property market, buying properties with strong upside before they get popular.

Most of the time if you follow where the market is already hot, you will be buying at a high.

The Market In Singapore Is At An All-Time High Now.

We need to be careful when selecting properties.

It is easy to get taken up by the hype and enter the market when it is hot, but to truly buy properties that have more than $200,000 upside you have to be in the right network.

As an investor myself, I have accumulated multiple properties and helped many of my students to do the same.

On top of that, I have also sourced projects that some of my students have successfully entered early and made a profit in them.

Yes, the market always goes higher.But while you wait for it to go higher, would you want to live a life of worry everyday?

Worries You Might Face:

Not Knowing howto pay that

mortgage

Seeing your rentalprofits get eaten away

by interest rate

increases

Thinking why youbought at the high

because you just

followed the crowd

Buying propertiesout of hype

Buying wrongtpyes of property

Or would you want to be totally relaxed knowing that when it comes down to it?

Even if the market crashes, the properties you buy are ROCK SOLID and have strong upside and rental strength.

My Fellow Investor, I Would Like To Invite You To Our New, Revamped Masterclass

Here's What You Will Discover In This Class:

How to see if a property has at least $200,000 upsidepotential

How to see if a property has at least $200,000 upsidepotential

Why rental income is NOT enough for you to survive a market downturn and what to do next in 2025

A battle-tested system that has been 4 market crashes(Asian Financial Crisis, SARS, Lehman Brothers, COVID) and

still manages to protect our student's property

portfolios

How rental income can be maximised without the hassleof tenant management

How rental income can be maximised without the hassleof tenant management

How to buy properties at a rock bottom price so youcan sleep soundly at night

How to buy properties at a rock bottom price so youcan sleep soundly at night

I encourage you to come visit us and learn why thousands of our students have successfully retired just on their property gains and rentals over the last 30 years!

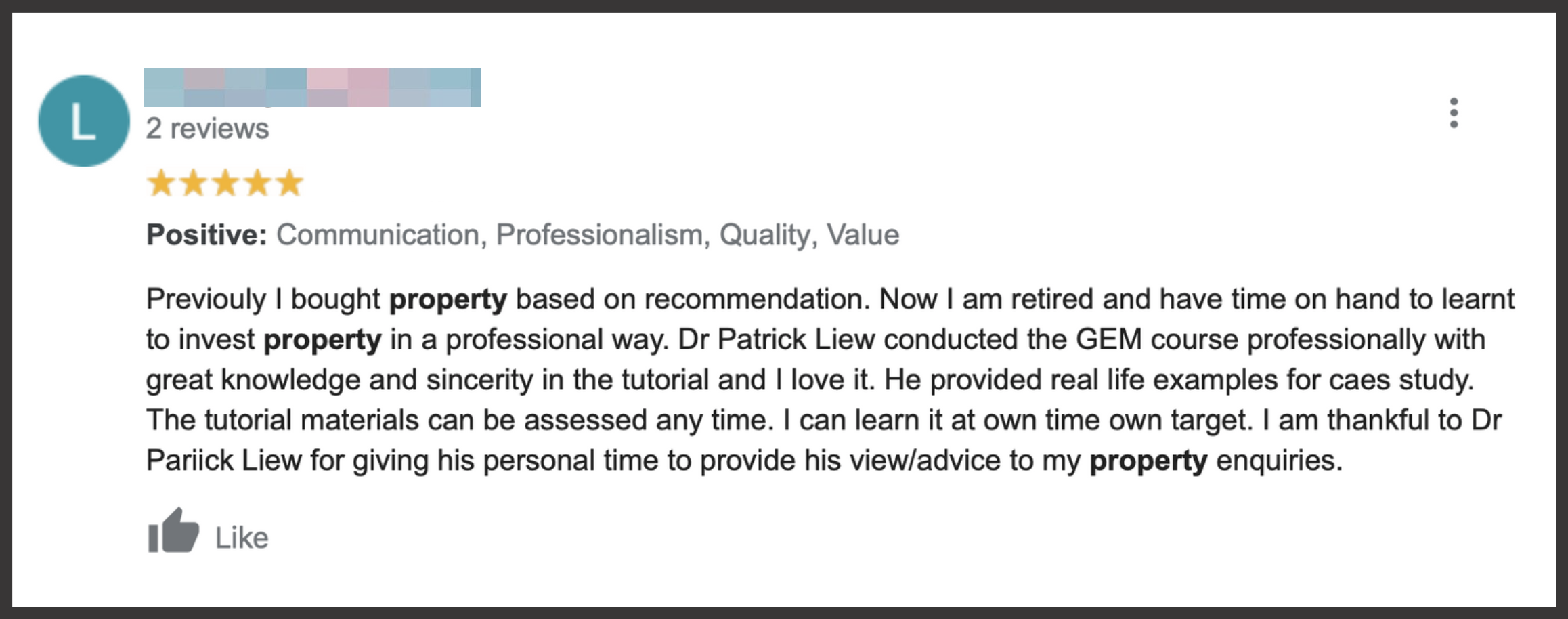

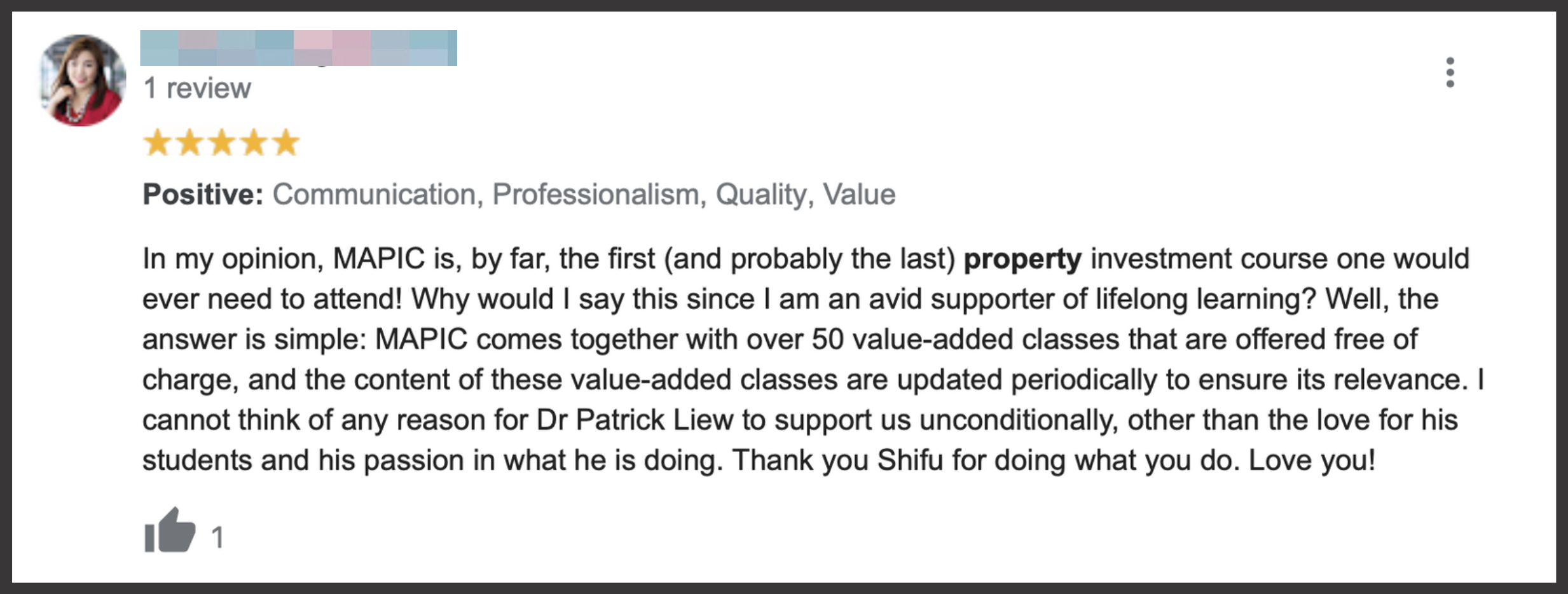

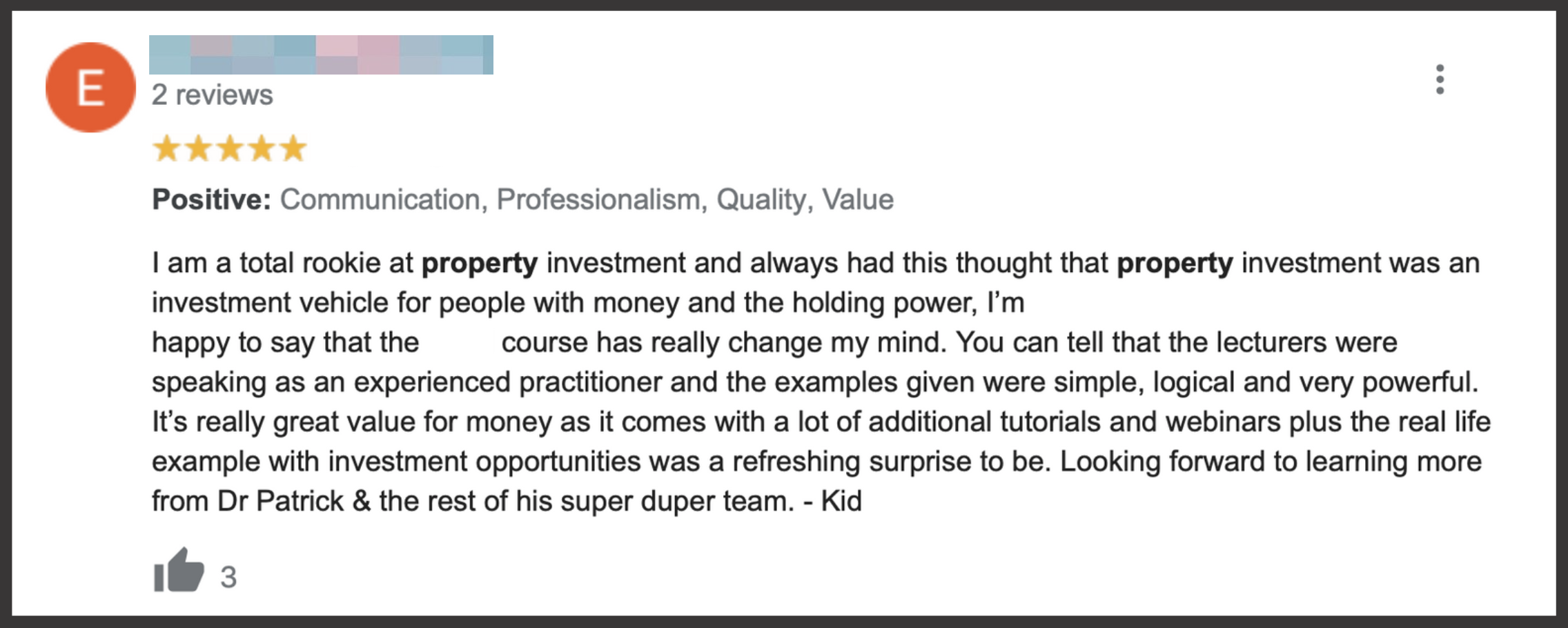

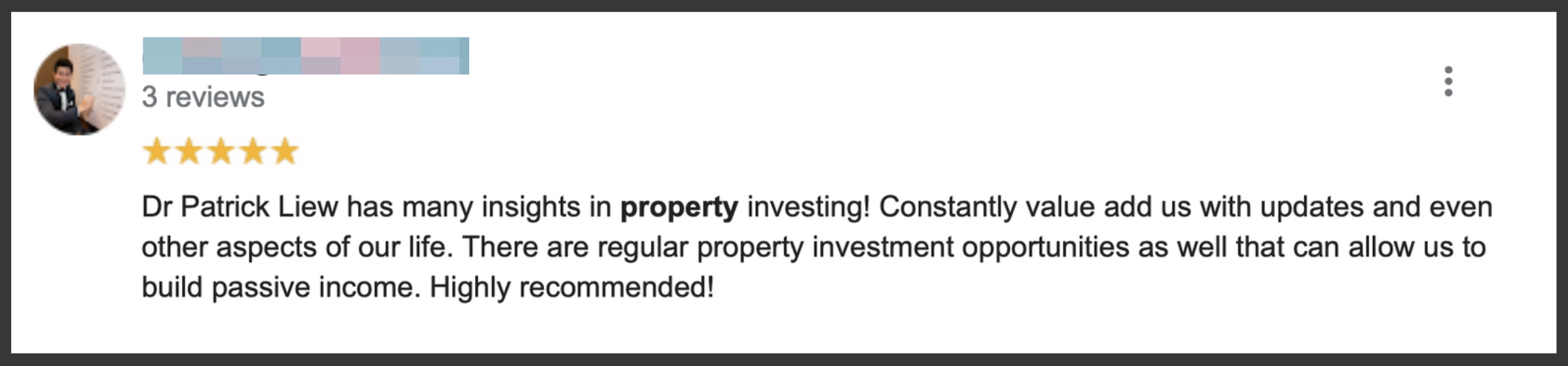

RAW, Unedited & REAL ReviewsFrom Real People Like YOU!

Hear From Our Community Members!

Hear From Other Internationally Renowned Trainers!

KEEN TO FIND OUT MORE?REGISTER NOW FOR OUR FREE LIVE SEMINAR!

GEX Academy Pte Ltd and its related companies and partners are not licensed, approved, registered or in any other way authorized or regulated by MAS, and as such are not licensed or approved to conduct any MAS-regulated activity.